Priority Sectors for Investment

Energy Sector

Bindhyabasini Hydropower Development Company Limited (BHDC) was incorporated in 2057/09/03 to develop, operate and maintain 15.4 MW project through the corridor of Rudi Khola compromising two cascade projects of Rudi A (8.8 MW) and Rudi B (6.6 MW). The authorized share capital of BHDC is 200 Crores. BHDC is focused on developing and implementing affordable renewal …

Peoples Energy Limited (PEL), previously Peoples Hydro Co-operative Ltd., is established with the objective of generating hydroelectricity through optimum utilization of resources in Nepal. The concept of the company came from a meeting with few investors in Kathmandu under the coordination of Mr. Krishna Acharya in 2065 BC. The main objective of the company is to mobilize the investment from all the …

Multi Energy Development Private Limited is spearheading an impressive 20MW hydropower venture in Gosainkunda Rural Municipality, Rasuwa district, set to generate an average annual energy of 119.15GWh post-outage. With a project cost of NPR 4 billion, backed by NPR 2.73 billion in bank financing and 1.27 billion equity investment, the project boasts a projected revenue of 64.22 Lakh per GWh and …

Balephi Energy Private Limited is currently constructing an impressive 40MW hydroelectric power plant (HEP) in Jugal Rural Municipality, located in the Sindhupalchowk district. Upon completion, the project is expected to generate an average annual energy output of 226.535 GWh, even after accounting for potential outages. The total estimated cost for the project stands at approximately NPR 8.6 billion, with the average ….

Manufacturing / Hospitality / Assets

Aero Bricks Company Pvt. Ltd. Is one of the oldest manufacturers of Autoclaved Aerated Concrete Blocks in Nepal. Founded in 2015, the company started its production of Aero Lite AAC Blocks in 2016 through its modern and fully automated German technology plant based in Chitwan with a production capacity of 500 cubic meters of AAC blocks per day. Aero Bricks Company Pvt. Ltd. Is an ISO 9001:2015 …

A fulfilling experience of the rich Newari and Nepali hospitality and architecture in the heart of Kathmandu’s tourist hub Thamel is what Hotel Thamel House warmly offers to you. In Thamel’s bustle abuzz with concretized buildings and Western-style lodges, Hotel Thamel House truly stands out as an architecturally and purposefully rare and unique edifice that immerses you into the ambiance …

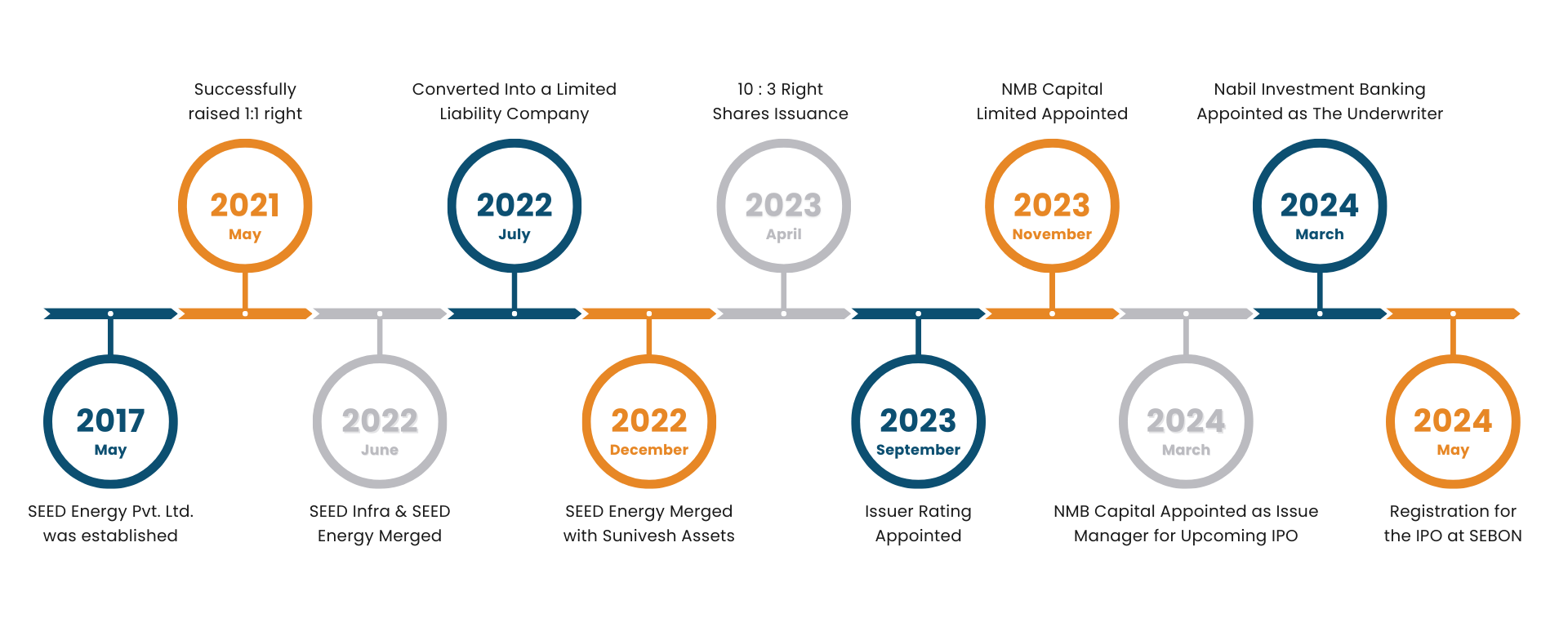

SEED Energy Limited has its corporate office in the building it owns, which also leases commercial spaces. It’s located on the main lane of Yala Sadak at Jawalakhel. The building covers 1,350 square meters of built-up space and sits on a land area of approximately 485 square meters. The total rentable space within the building has been divided into 11 units …